It is no surprise that Bitcoin, a secure, global, and digital currency has claimed the interest of investors.

Thinking of investing in Bitcoin?

This post will outline some things you NEED to know before you buy.

Who invented BITCOIN ?

Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto and released as open-source software in 2009.

The identity of Nakamoto remains unknown.

What is BITCOIN ?

Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer and transactions take place between users directly through the use of cryptography, without an intermediary. These transactions are verified by network nodes and recorded in an immutable public distributed ledger called a blockchain.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, over 100,000 merchants and vendors accepted bitcoin as payment. Research produced by the University of Cambridge estimates that in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.

Smaller units of BITCOIN

Small amounts of bitcoin used as alternative units are millibitcoin (mBTC) and satoshi. Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoin, one hundred millionth of a bitcoin. A millibitcoin equals to 0.001 bitcoin, one thousandth of a bitcoin or 100,000 satoshis.

DESIGN of BITCOIN

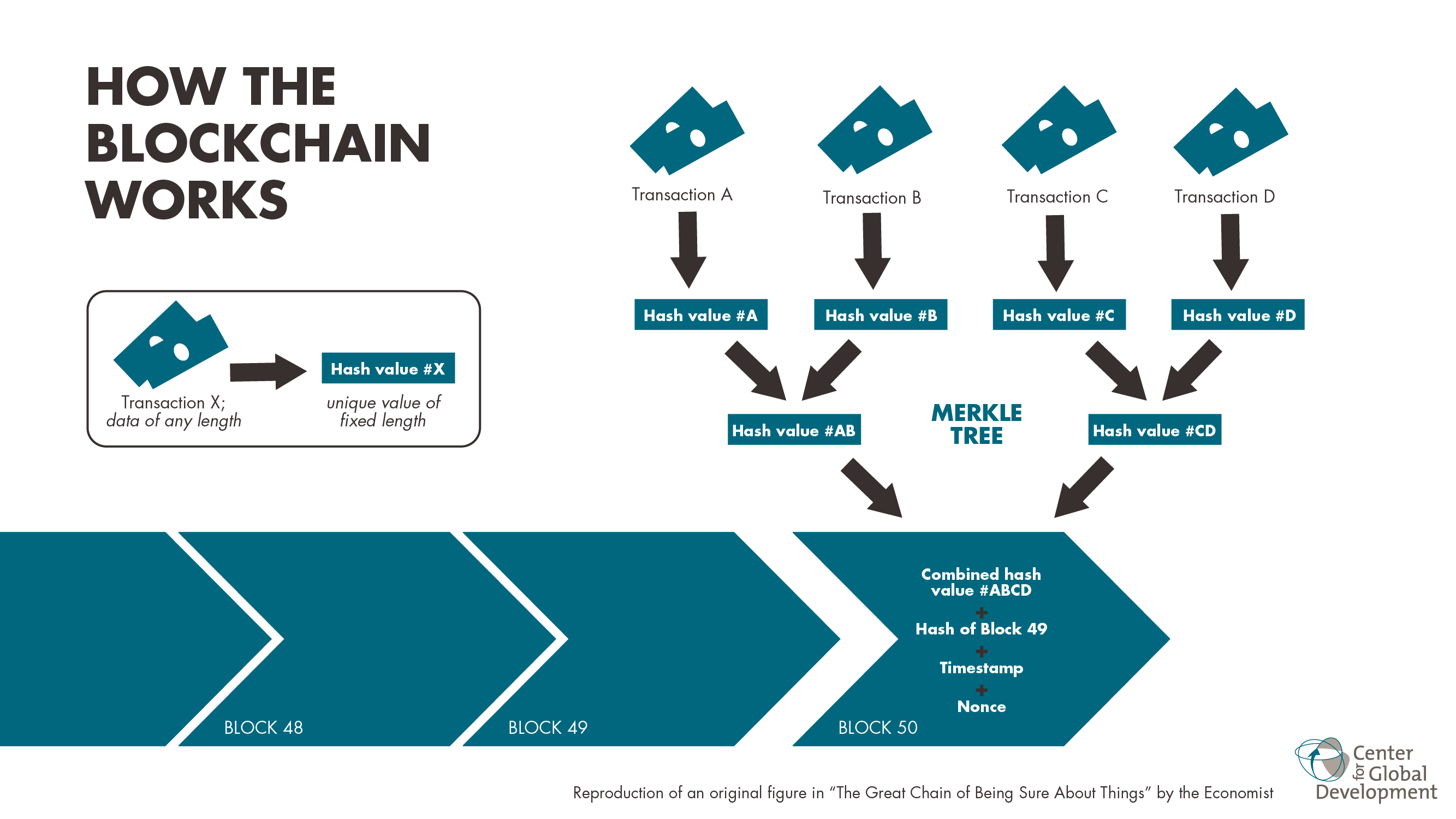

Blockchain

The blockchain is a public ledger that records bitcoin transactions. A novel solution accomplishes this without any trusted central authority: the maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software. Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications. Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain. Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.

Transactions

Transactions are defined using a Forth-like scripting language. Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer. Any input satoshis not accounted for in the transaction outputs become the transaction fee.

Transaction Fees

Paying a transaction fee is optional. Miners can choose which transactions to process and prioritize those that pay higher fees. Fees are based on the storage size of the transaction generated, which in turn is dependent on the number of inputs used to create the transaction. Furthermore, priority is given to older unspent inputs.

Ownership

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse (computing the private key of a given bitcoin address) is mathematically unfeasible and so users can tell others and make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key.

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key. A backup of his key(s) would have prevented this.

Mining

Mining is a record-keeping service done through the use of computer processing power. Miners keep the blockchain consistent, complete, and unalterable by repeatedly verifying and collecting newly broadcast transactions into a new group of transactions called a block. Each block contains a cryptographic hash of the previous block, using the SHA-256 hashing algorithm, which links it to the previous block, thus giving the blockchain its name. Miners may aggregate mining resources in a mining pool.

To be accepted by the rest of the network, a new block must contain a so-called proof-of-work. The proof-of-work requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target. This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is 0, 1, 2, 3, ... before meeting the difficulty target.

Every 2,016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.

Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted. As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.

Supply

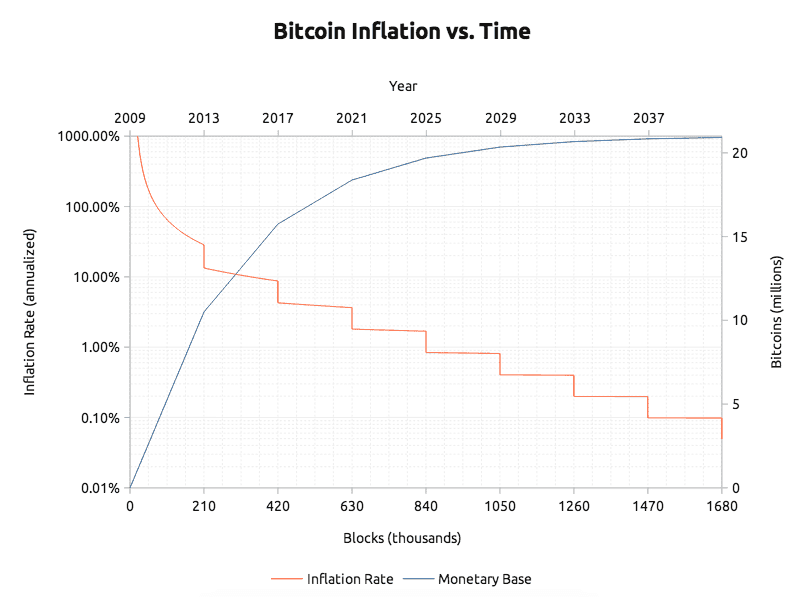

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees. As of 9 July 2016, the reward amounted to 12.5 newly created bitcoins per block added to the blockchain. To claim the reward, a special transaction called a coinbase is included with the processed payments. All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years). Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins[e] will be reached the record keeping will then be rewarded by transaction fees solely.

In other words, bitcoin's inventor Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that there would only ever be 21 million bitcoins in total. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.

Wallets

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A better way to describe a wallet is something that "stores the digital credentials for your bitcoin holdings" and allows one to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated. At its most basic, a wallet is a collection of these keys.

There are several types of wallets. Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership. Software wallets can be split further in two categories: full clients and lightweight clients.

Full clients verify transactions directly on a local copy of the blockchain (over 136 GB as of October 2017), or a subset of the blockchain (around 2 GB).[better source needed] They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules. Because of its size and complexity, storing the entire blockchain is not suitable for all computing devices.

Lightweight clients on the other hand consult a full client to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust the server to a certain degree, as it can report faulty values back to the user. Lightweight clients follow the longest blockchain and do not ensure it is valid, requiring trust in miners.

With both types of software wallets, the users are responsible for keeping their private keys in a secure place.

Besides software wallets, Internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware. As a result, the user must have complete trust in the wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen.

Physical wallets store the credentials necessary to spend bitcoins offline. Examples combine a novelty coin with these credentials printed on metal. Paper wallets are simply paper printouts. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.

Privacy

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses. Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.

To heighten financial privacy, a new bitcoin address can be generated for each transaction. For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys. Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs.

Economics related to BITCOIN

Acceptance by merchants

In 2015, the number of merchants accepting bitcoin exceeded 100,000. Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees under 2%, down to 0%. Firms that accepted payments in bitcoin as of December 2014 included PayPal, Microsoft, Dell, and Newegg.

Payment service providers

Merchants accepting bitcoin ordinarily use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency, and sends the obtained amount to merchant's bank account, charging a fee for the service.

As an investment

Some Argentinians have bought bitcoins to protect their savings against high inflation or the possibility that governments could confiscate savings accounts. During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.

The Winklevoss twins have invested into bitcoins. In 2013 The Washington Post claimed that they owned 1% of all the bitcoins in existence at the time.

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission. Forbes started publishing arguments in favor of investing in December 2015.

In 2013 and 2014, the European Banking Authority and the Financial Industry Regulatory Authority (FINRA), a United States self-regulatory organization, warned that investing in bitcoins carries significant risks. Forbes named bitcoin the best investment of 2013. In 2014, Bloomberg named bitcoin one of its worst investments of the year. In 2015, bitcoin topped Bloomberg's currency tables.

According to bitinfocharts.com, in 2017 there are 9,272 bitcoin wallets with more than $1 million worth of bitcoins. The exact number of bitcoin millionaires is uncertain as a single person can have more than one bitcoin wallet.

Venture capital

Venture capitalists, such as Peter Thiel's Founders Fund, which invested US$3 million in BitPay, do not purchase bitcoins themselves, instead funding bitcoin infrastructure like companies that provide payment systems to merchants, exchanges, wallet services, etc. In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper, with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins, at the time called 'mystery buyer'. The company's goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake. Investors also invest in bitcoin mining. According to a 2015 study by Paolo Tasca, bitcoin startups raised almost $1 billion in three years (Q1 2012 – Q1 2015).

Criticism

Energy consumption

Bitcoin has been criticized for the amounts of electricity consumed by mining.

In 2013, Mark Gimein estimated electricity use to be about 40.9 megawatts (982 megawatt-hours a day). In 2014, Hass McCook estimated 80.7 megawatts (80,666 kW). As of 2015, The Economist estimated that even if all miners used modern facilities, the combined electricity consumption would be 166.7 megawatts (1.46 terawatt-hours per year). The Guardian said that as of November 2017, the global bitcoin mining activity was estimated to consume 3.4 gigawatts.

Journalist Matt O'Brien said that it is not obvious whether bitcoin is lowering transaction costs, since the costs are transformed into pollution costs, which he said are "environmental spillovers on everyone else, or what economists call negative externalities."

To lower the costs, bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free.[79] Chinese bitcoin miners are known to use hydroelectric power in Tibet to reduce electricity costs.

Criminal activity

The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media. The FBI prepared an intelligence assessment, the SEC has issued a pointed warning about investment schemes using virtual currencies, and the US Senate held a hearing on virtual currencies in November 2013.

Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods. In 2014, researchers at the University of Kentucky found "robust evidence that computer programming enthusiasts and illegal activity drive interest in bitcoin, and find limited or no support for political and investment motives."

Why Invest in Bitcoin?

It seems silly to some people that one bitcoin can be worth hundreds of dollars.

What makes bitcoins valuable?

Bitcoins are scarce and useful.

Let’s look to gold as an example currency. There is a limited amount of gold on earth.

As new gold is mined, there is always less and less gold left and it becomes harder and more expensive to find and mine.

The same is true with Bitcoin.

There are only 21 million Bitcoin, and as time goes on, they become harder and harder to mine. Take a look at Bitcoin’s inflation rate and supply rate:

In addition to being scarce, bitcoins are useful.

Bitcoin provides sound and predictable monetary policy that can be verified by anyone.

Bitcoin’s sound monetary policy is one of its most important features. It’s possible to see when new bitcoins are created or how many bitcoins are in circulation.

Bitcoins can be sent from anywhere in the world to anywhere else in the world. No bank can block payments or close your account. Bitcoin is censorship resistant money.

Bitcoin makes cross border payments possible, and also provides an easy way for people to escape failed government monetary policy.

The internet made information global and easy to access. A sound, global currency like Bitcoin will have the same impact on finance and the global economy.

If you understand the potential impact of Bitcoin, it won’t be hard to hard to understand why investing in bitcoin may be a good idea.

When is the right time to buy?

As with any market, nothing is for sure.

Throughout its history, Bitcoin has generally increased in value at a very fast pace, followed by a slow, steady downfall until it stabilizes.

Use tools like Bitcoin Wisdom or Cryptowatch to analyze charts and understand Bitcoin’s price history.

Bitcoin is global and not affected by any single country’s financial situation or stability.

For example, speculation about the Chinese Yuan devaluating has, in the past, caused more demand from China, which also pulled up the exchange rate on U.S. and Europe based exchanges.

Global chaos is generally seen as beneficial to Bitcoin’s price since Bitcoin is apolitical and sits outside the control or influence of any particulate government.

When thinking about how economics and politics will affect Bitcoin’s price, it’s important to think on a global scale and not just about what’s happening in a single country.

How to Invest in Bitcoins and Where to Buy?

The difficulty of buying bitcoins depends on your country. Developed countries have more options and more liquidity.

Coinbase is the world’s largest bitcoin broker.

Unicorn, Bitxoxo, Zebpay are other bitcoin exchanges.

How to secure BITCOINS?

As with anything valuable, hackers, thieves, and scammers will all be after your bitcoins, so securing your bitcoins is necessary.

If you’re serious about investing in bitcoin and see yourself buying a significant amount, we recommend using Bitcoin wallets that were built with security in mind.

Ledger Nano S – Ledger is a Bitcoin security company that offers a wide range of secure Bitcoin storage devices. We currently see the Ledger Nano S as Ledger’s most secure wallet. Read more about the Ledger Nano or buy one.

TREZOR – TREZOR is a hardware wallet that was built to secure bitcoins. It generates your Bitcoin private keys offline. Read more about TREZOR or buy one.

Bitcoins should only be kept in wallets that you control.

If you leave $5,000 worth of gold coins with a friend, your friend could easily run off with your coins and you might not see them again.

Because Bitcoin is on the internet, they are even easier to steal and much harder to return and trace. Bitcoin itself is secure, but bitcoins are only as secure as the wallet storing them.

Investing in bitcoin is no joke, and securing your investment should be your top priority.

Hope you have got all your answers..

[Source : Wikipedia]

Stay connected with us for more Tech News..

Develop your own cryptocurrency.

ReplyDeleteWe deliver the best cryptocurrency exchange software with latest features like Margin

Trading, Lending, Grouping etc

cryptocurrency exchange software.

cryptocurrency exchange platform.

blockchain development companies.

Cryptocurrency exchange software Create your own crypto bank.

ty for post

ReplyDeletethanks for post

ReplyDelete